2Checkout vs. Stripe vs. FastSpring: Comparing Payments, Taxes, and Platform Features (+ Pricing)

FastSpring

OCTOBER 13, 2023

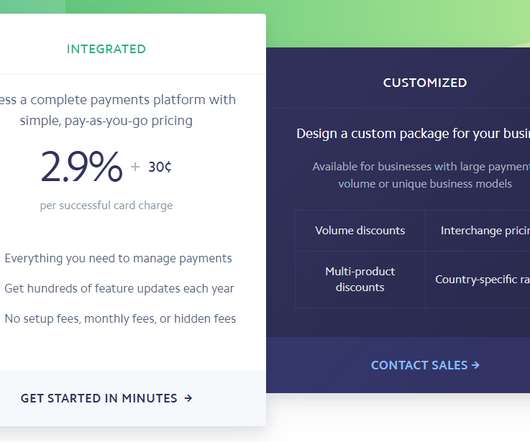

TL;DR : Stripe markets themselves as a payment services provider (PSP), 2Checkout is a payment service provider with an upgrade option to make them your merchant of record (MoR), and FastSpring is a comprehensive merchant of record from the outset. Payment Gateways , Payment Processing , PSPs, MoRs — What’s the Difference?

Let's personalize your content