Braintree Payments Reviews (Nov 2020) – Everything You Need to Know

Ecommerce Platforms

NOVEMBER 23, 2020

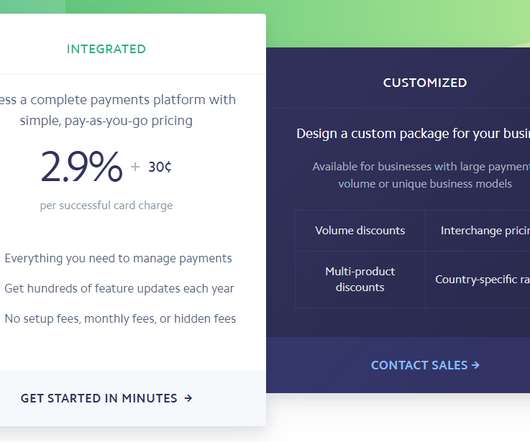

Here we look briefly at Chicago-based Braintree Payments, highlighting some of the features a merchant might consider when picking a payment processor. Today, Braintree is one of the biggest payment solutions in the landscape, offering an excellent selection of tools for business owners to explore.

Let's personalize your content