COVID-19 Stokes The Chatbot Hype In Financial Services

Forrester eCommerce

SEPTEMBER 18, 2020

COVID-19 and the associated containment measures are accelerating digital transformation and automation in financial services.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Services Related Topics

Financial Services Related Topics

Forrester eCommerce

SEPTEMBER 18, 2020

COVID-19 and the associated containment measures are accelerating digital transformation and automation in financial services.

Forrester eCommerce

OCTOBER 16, 2023

According to Forrester’s Marketing Survey, 2023, financial services marketers in Asia Pacific (APAC) find improving marketing’s ROI or effectiveness more difficult than their peers in other regions and industries.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

What Your Financial Statements Are Telling You—And How to Listen!

A Roadmap For Modernization: How To Break Free From Your Monolith Before July 31, 2026

Forrester eCommerce

SEPTEMBER 19, 2023

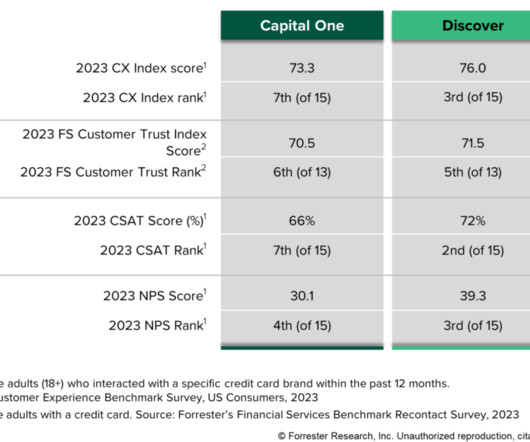

US financial services brands are struggling to earn high levels of customer trust. Forrester’s Financial Services Customer Trust Index (FS Trust Index) revealed that customer trust in US financial services firms in 2023 was relatively weak and largely unchanged from 2022.

Forrester eCommerce

SEPTEMBER 28, 2021

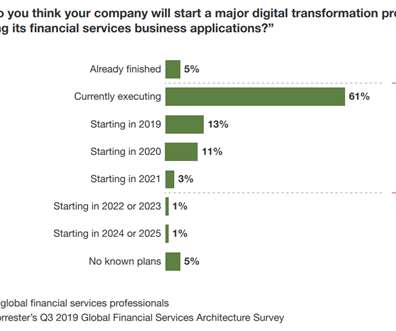

Banks and other financial services firms always ask: “What are the others doing?” Source: Financial Services Firms Have Solid […].

Forrester eCommerce

NOVEMBER 7, 2018

In the decade since the global financial crisis, much of the financial services industry has made a strong recovery. While many governments are still nursing large debts, most banks, investment management firms, and insurance companies have long since returned to good health.

Forrester eCommerce

SEPTEMBER 26, 2019

Many financial services firms say that they are already delivering on personalization and view improving their personalization capabilities and technology further as a top priority. But financial services companies’ current personalization efforts are nowhere near the level necessary to engage increasingly demanding customers.

Forrester eCommerce

JUNE 19, 2019

Business leaders in the financial services (FS) industry are used to tracking success with measures that reflect shareholder, investor and market regulator values like return on equity, net profit, assets under management and capital adequacy ratio. This is the ‘money story’.

Forrester eCommerce

AUGUST 22, 2019

Indian financial service customers are changing! Forrester surveyed 3,000 online adults in India on their financial attitude, expectations, and preferences and found that more than half of customers accessing the internet are constantly online. ” As digital […].

Forrester eCommerce

AUGUST 3, 2021

Financial services firms that embrace sustainable business models have an opportunity to win over values-based customers.

Forrester eCommerce

AUGUST 15, 2019

While it’s still early days, the shift toward autonomous services is already happening in financial services thanks to evolving customer expectations, advances in AI and other […].

Forrester eCommerce

OCTOBER 15, 2020

2020 has been a challenging year for financial services. First, COVID-19 hit insurers with business interruption and travel insurance claims. Then, banks’ profits took a hit as banks set aside billions for loan loss provisions.

Forrester eCommerce

JUNE 22, 2020

And with so many assets in transition and the broad interest in customer experience in financial services, it’s tempting to think that banks, insurers, and wealth managers recognize a great opportunity […].

Retail TouchPoints

MARCH 31, 2023

And it’s increasingly clear that brands that embrace financial services within the customer journey are scoring highly on engagement scores. The only problem is, for many retailers, the idea of becoming involved in the financial transaction part of the journey is a leap too far.

Forrester eCommerce

FEBRUARY 28, 2023

I’ve been working with a long list of financial services companies from various subsectors on their cloud strategies. It’s been a long road for financial services and cloud. Financial services have […] Here’s a little bit of history.

Forrester eCommerce

MAY 1, 2023

Financial services (FS) firms are no strangers to innovation. With high regulatory pressure, FS firms innovate within boundaries, create digital services protected behind corporate firewalls, abide by tenancy isolation rules, and ensure […] Still, this process is not unfettered.

Forrester eCommerce

JUNE 4, 2020

We are living in uncertain and extraordinary times, and extraordinary feats are being delivered daily by committed workforces for which speed translates into jobs, businesses — and lives — saved.

Forrester eCommerce

JUNE 27, 2023

We have launched the European Financial Services Customer Trust Index, 2022. Sadly, customers in France, Germany, Italy, and the UK generally rate their trust toward their banks as weak or — at best — moderate.

Forrester eCommerce

JUNE 14, 2023

At Forrester, we see financial services firms […] Our data at Forrester backs this up: Industry solutions grow at a compounded annual growth rate of 13.9%, a rate faster than horizontal customer experience tech.

Forrester eCommerce

FEBRUARY 5, 2023

Financial services (FS) firms are actively participating in it, increasingly commercializing their data to create new revenue streams and expand business opportunities. The growth of the data economy in China is accelerating.

Forrester eCommerce

AUGUST 6, 2020

Putting financial well-being at the core of their strategy is critical to financial services firms’ ability to win, serve, and retain customers. To develop their financial well-being program, financial services providers are evaluating and adopting a range of contributing technologies.

Forrester eCommerce

NOVEMBER 8, 2022

How successful have financial services firms been in garnering the trust of their customers amidst inflation and market volatility? Not very successful, it seems.

Forrester eCommerce

NOVEMBER 8, 2022

How well did US financial services firms rank in terms of customers’ trust in 2022? Our new research reveals the scores and rankings of 54 US brands across auto and home insurance, banking, credit card issuers, and investment firms, analyzed as part of Forrester’s US Financial Services Trust Index, 2022.

Forrester eCommerce

JANUARY 18, 2023

Many financial services executives buy into the concept of customer obsession, but too few take actions that build a customer-obsessed culture. That is the top-level finding from our just-published “The State Of Customer Obsession In Financial Services, 2022” research report.

Forrester eCommerce

OCTOBER 26, 2022

In response, leading financial services firms across banking, investment and insurance have launched an array […]. In fact, Forrester believes we’re in the early stages of The Green Market Revolution – a historic business opportunity, on par with the first and second industrial revolutions.

Forrester eCommerce

OCTOBER 23, 2023

Apple's fintech plays have big implications for its core market and financial services. But it's not the only tech company making moves.

Forrester eCommerce

MAY 5, 2020

Adapters (many financial services firms or utilities) have seen severe disruption, but parts of their business may only see minor disruption or even an […].

Forrester eCommerce

MAY 15, 2020

A new crop of challenger brands, such as Alibaba, Amazon, Apple, Google, Starbucks, T-Mobile, Tencent, and Walmart, are on the prowl in the financial services category. And that should have traditional financial brands worried — very worried.

Forrester eCommerce

AUGUST 11, 2021

Open finance will change little in the next couple of years — but will transform financial services over the coming decade.

Forrester eCommerce

MAY 8, 2023

Earning and defending customers’ trust, considering the current volatility in financial markets, the infamous downfall of Credit Suisse, the collapse of First Republic Bank, and the ongoing banking scandal in China, requires a special commitment, not lip service.

Forrester eCommerce

NOVEMBER 17, 2021

Traditional financial services firms will make non-traditional moves and look to innovate to stay competitive in the year ahead.

Forrester eCommerce

AUGUST 17, 2023

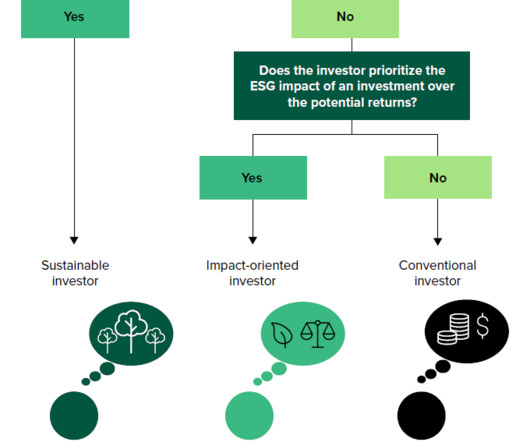

Impact-Oriented Investors Are Waiting For A Reason To Take The Plunge Data from Forrester’s Financial Services Benchmark Recontact Survey, 2022, found that 15% of US online adult investors own sustainable investment products — a group we call “sustainable investors.” But wealth managers should also […]

Forrester eCommerce

SEPTEMBER 25, 2019

I’ve spent the past three weeks interviewing global financial institutions, fintech startups, and technology vendors to gain a broader perspective on how financial experiences will evolve in the coming years.

Forrester eCommerce

MARCH 10, 2021

This is steadily changing distribution patterns within the industry towards embedded finance – a world of connectivity, financial services meeting the needs of customers in the moment, in cars, in virtual agents, in shopping apps, in online marketplaces. Open finance is driven not by regulators, but by technologies like open APIs.

Forrester eCommerce

JANUARY 9, 2025

One of the largest insurance and financial services providers in the US, Nationwide offers a diverse portfolio of products and services to both consumers and businesses. The company recently overhauled its approach, starting […]

Forrester eCommerce

MARCH 1, 2023

I looked at the Budget 2023 that India’s Finance Minister presented on Feb 1st 2023. On that day, India’s Prime Minister tweeted, “This year’s Budget infuses new energy to India’s development trajectory”. I find that he was not far off the mark.

Forrester eCommerce

OCTOBER 2, 2023

In certain industries such as financial services, IT has an outsized contribution to overall corporate scope 1, scope 2 and scope 3 emissions. The demand […]

Forrester eCommerce

MAY 20, 2024

Capital One’s plan to acquire Discover will change the shape of the financial services landscape (though not the fundamental forces that drive growth and success – but more on that later).

Forrester eCommerce

MARCH 29, 2021

Financial services firms have a large role to play in […]. Tariq Fancy – BlackRock’s former Chief Investment Officer of Sustainable Investing – caused an uproar recently when he denounced sustainable investing as just “marketing hype” and “PR spin.”

Forrester eCommerce

JULY 9, 2020

Open banking intermediaries are forming a new technology segment within financial services, to meet this need and simplify compliance, offering integration and aggregation layers between banks and third-party providers. VCs poured over […].

Forrester eCommerce

JULY 10, 2023

We analyzed the 2022 data to assess data breaches across seven primary industries: manufacturing; retail and wholesale; business services and construction; utilities and telecommunications; financial services and insurance; public sector and healthcare; and […]

Forrester eCommerce

AUGUST 18, 2021

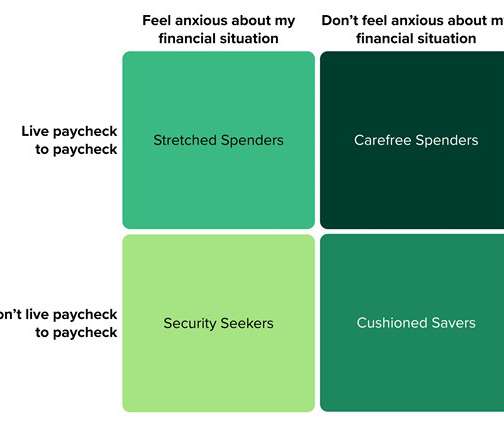

To help financial services firms understand where UK consumers stand on the financial well-being spectrum, Forrester surveyed 2,519 online adults in 2020.

Forrester eCommerce

JULY 17, 2019

Temenos has announced that it has acquired Logical Glue, a small vendor of financial-services-specific AI software covering use cases like credit scoring and underwriting.

Forrester eCommerce

MARCH 19, 2020

In early March we held our 5th Annual Financial Services Summit 2020 in both Sydney and Melbourne, where I presented on how customer-obsessed CIOs are driving business success by: Accepting that the firm’s ultimate customer is also IT’s customer; Engaging across a wide, business-focused field while taking responsibility for revenue generating initiatives; (..)

Forrester eCommerce

AUGUST 19, 2024

Singapore’s FSI Customers Rate Their Experiences As Just “OK” In 2024 Forrester has been evaluating the quality of customer experience at leading financial service providers in Singapore since 2018.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content