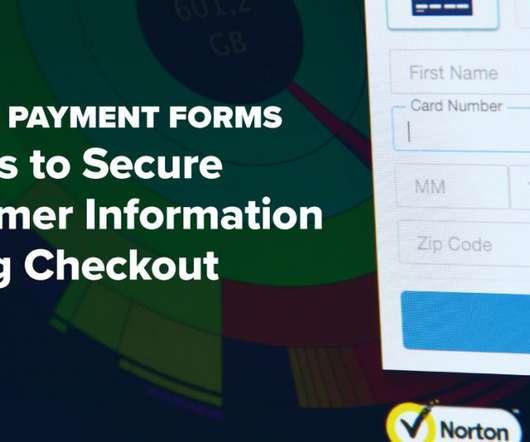

Addressing Emerging Threats to Mobile Payments: Securing Ecommerce Through SDK Protection

Retail TouchPoints

NOVEMBER 7, 2024

The rapid adoption of mobile apps has led to a similar boom in mobile commerce, leading mobile brands to quickly adopt payment Software Development Kits (SDKs) to add functionality quickly and efficiently. However, this reliance on SDKs also introduces significant security risks.

.png

)

Let's personalize your content