How Mobile Payments Are Taking Over eCommerce

Groove

JUNE 15, 2022

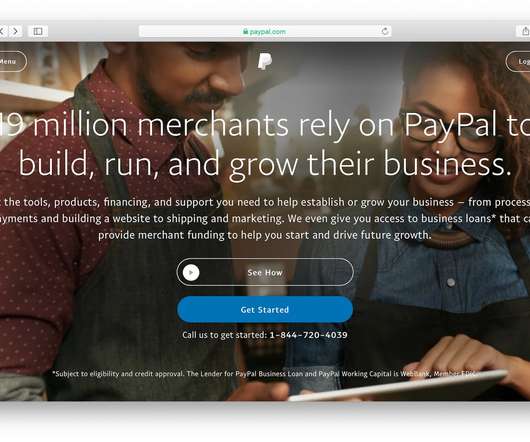

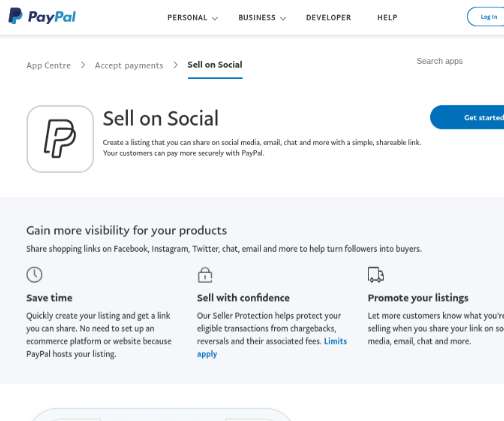

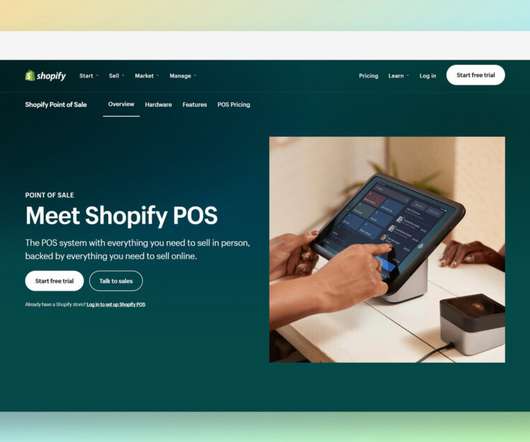

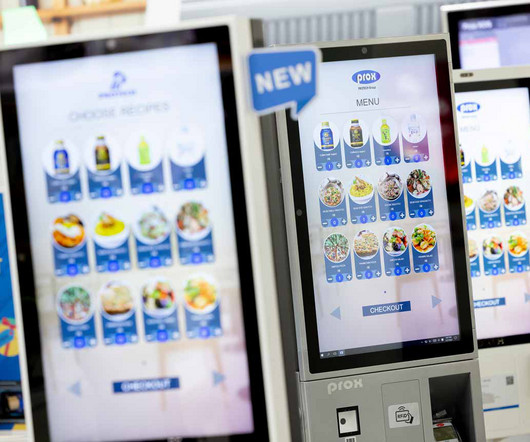

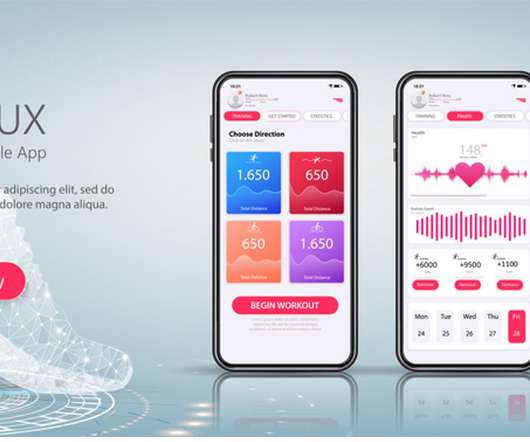

The new way of purchasing goods and services is through Mobile Payments whether you are shopping online or in-store. As millions of users start to use mobile payments each year, it is projected that 4.8 billion people will be completing transactions through mobile payments by 2025. What Are Mobile Payments?

.png

)

Let's personalize your content